The Gift Aid Declaration¶

On install, a "Gift Aid" profile is created for you.

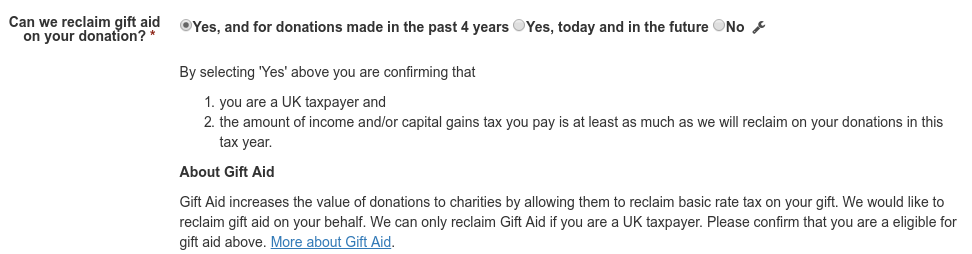

If you add this to a contribution page the user can make a gift aid declaration:

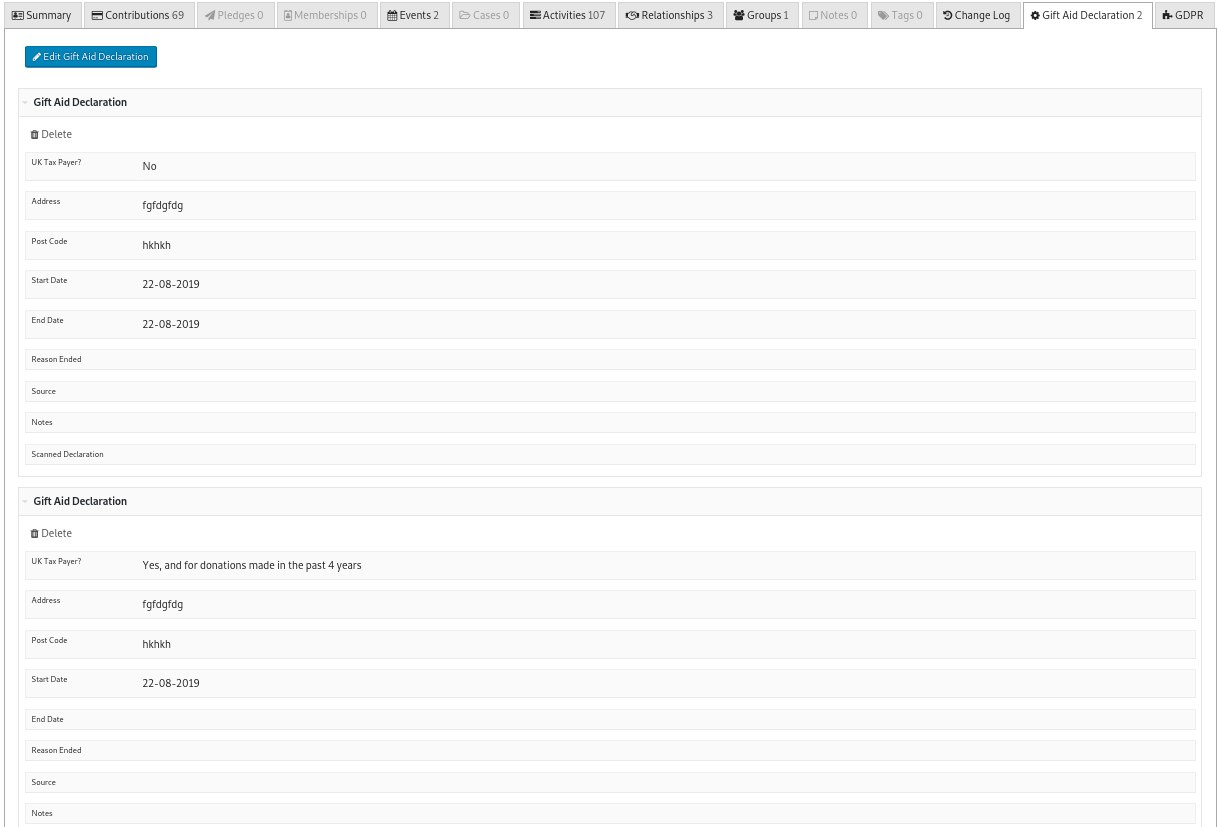

It will then appear on the contact record:

Declaration Fields¶

Eligible for Gift Aid¶

Yes, and for donations made in the past 4 years¶

The donor has declared that gift aid can be claimed on all eligible contributions today, in the future AND going back 4 years from today.

Yes, today and in the future¶

The donor has declared that gift aid can be claimed on all eligible contributions today and in the future.

No¶

The donor has declared that gift aid can NOT be claimed on eligible contributions today and in the future.

Address / Postcode¶

- The contact "Primary" address is used.

- It is formatted and filtered according to HMRC rules and then copied to the declaration automatically.

End Date¶

The current declaration represents the current status and will not have an end date set. This applies even if the

declaration is "No" - because it will represent a time period between start_date/end_date where the contact was not eligible.

Source¶

When updated by admin the source field can be filled in. If updating via a contribution/registration form the source will normally be set to the title of that form.

Creating/Updating Declarations¶

- Declarations can be entered manually by admin staff on the contact record if they have received them from the donor.

- Declarations can be entered by the donor if the "Eligible for Gift Aid" field is provided on the contribution/registration page. A default profile is configured in CiviCRM that can be included.

Transitioning from one type to another¶

No existing declaration¶

A new declaration is setup with start date today and "Eligible for Gift Aid" set to whatever was selected on the form.

Existing "No" declaration¶

If the new declaration is "Yes and past 4 years" or "Yes":

-

The existing "No" declaration end date is set to the new declaration's start date (e.g. today).

-

A new declaration is created with start date set to the new declaration's start date (e.g. today).

If the new declaration is "No" then no changes are made.

Existing "Yes and past 4 years"/"Yes" declaration¶

If the new declaration is "No":

-

The existing declaration end date is set to the new declaration's start date and its "Reason Ended" field is set to "Contact Declined".

-

A new declaration is created with start date set to the new declaration's start date and eligible = "No".

If the new declaration is "Yes and past 4 years" and the existing declaration is "Yes":

-

If the start date of the existing declaration is greater than 4 years ago no changes are made.

-

If the start date of the existing declaration is less than 4 years ago the start date is changed today (not the new declaration's start date) and contributions in the past 4 years will become eligible for submitting to HMRC.

If the new declaration is "Yes" and the existing declaration is "Yes" or "Yes and past 4 years" no changes are made. As the donor has previously stated "Yes and past 4 years" it is up to the donor to inform the organisation if that declaration was made in error.